成交

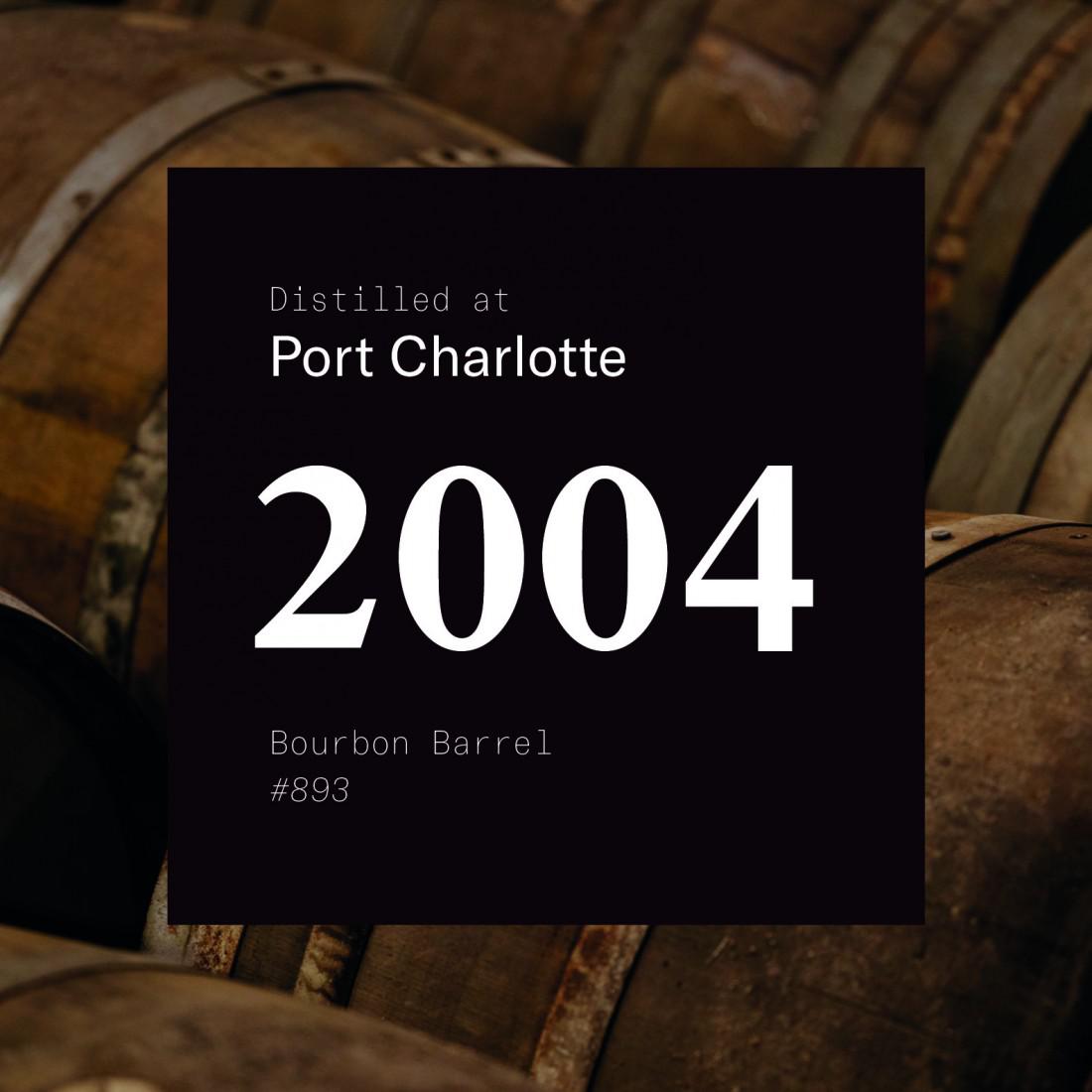

Cask: Port Charlotte 2004 Fresh Bourbon Barrel #893 / stored at Bruichladdich

结束时间: 2025-01-06

拍品详情

品牌: Bruichladdich

生产地: Islay

酒龄:

瓶装商: still in cask

净含量: 74.9 RLA as of 10/24

酒精度: 50.4% as of 10/24

桶型: Fresh Bourbon Barrel

装桶日期: 2004

酒款说明

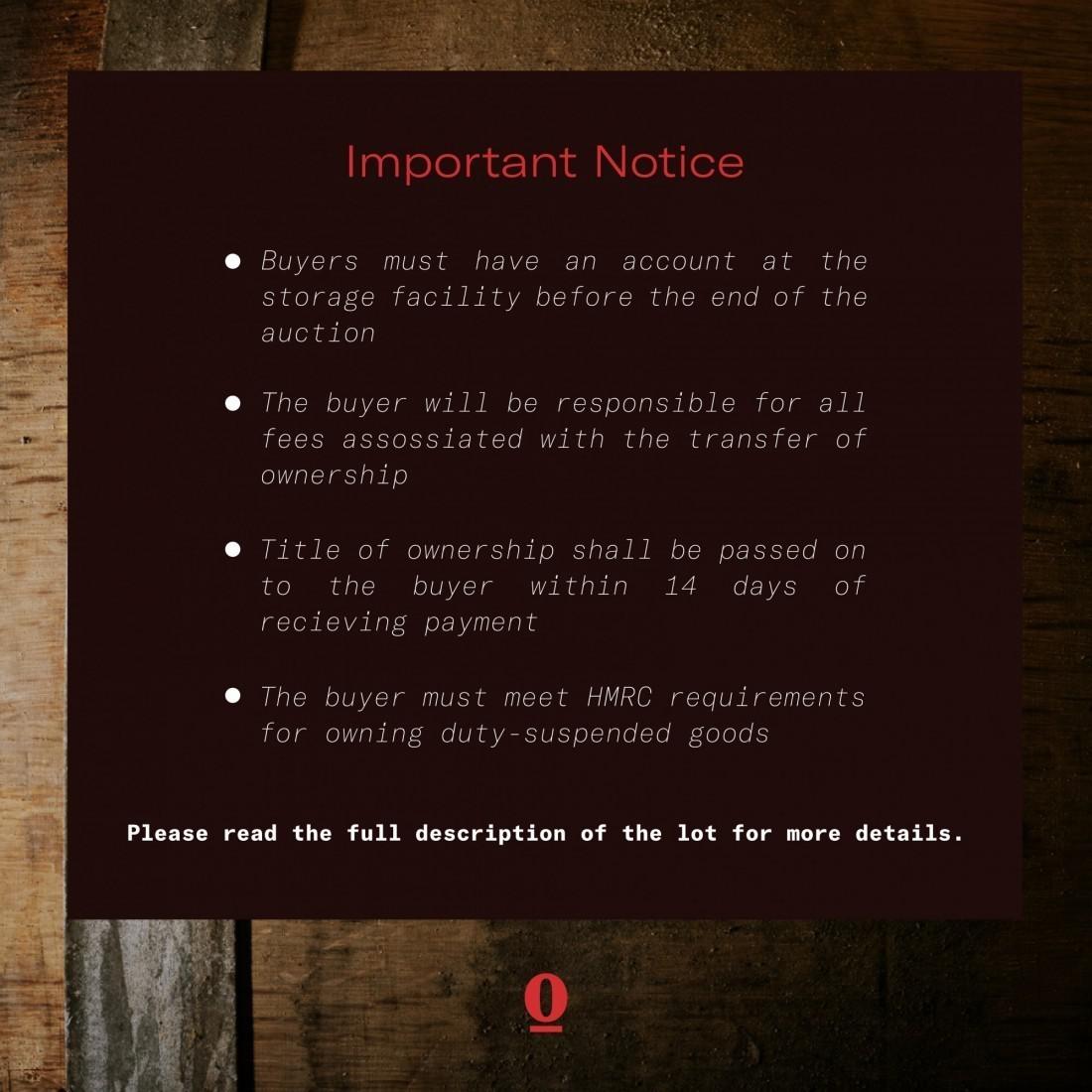

A cask for Port Chalotte single malt Scotch whisky.Single fresh bourbon barrel #893 was filled on 15th July 2004 and is currently in storage at Bruichladdich.The following are the results of a regauging which took place in October 2024.Port Charlotte is a heavily peated single malt produced at Bruichladdich distillery, introduced after Murray McDavid purchased the distillery 2001. The brand is named after a historic distillery in the eponymous neighbouring town. Having been traditionally an un-peated single malt due to the needs of its former owners for their blends, Murray McDavid were quick to diversify the Bruichladdich portfolio, also introducing the even peatier Lochindaal and Octomore.All relevant paperwork will accompany this purchase. Ownership of the cask will be transferred once payment is processed post auction. Any costs relating to storage, removal from storage, bottling and duty/tax payments will become the responsibility of the new owner.*IMPORTANT NOTICE: The buyer of any cask which is stored at this location must have an existing account with the company that owns the warehouse. Please note that the buyer will also be fully responsible for all fees associated with the transfer of ownership of the cask.Title of ownership for sold lots shall be passed on to the buyer within 14 days of the receipt of funds PROVIDED THAT a Buyer meets, and can demonstrate they meet, HMRC requirements for owning duty-suspended goods. In short: a UK resident revenue trader must have a valid Owners of Warehoused Goods Regulations Certificate (“WOWGR”). A UK resident who is not a revenue trader does not require a WOWGR but must make arrangements with the warehousekeeper storing the cask. Non-UK residents should appoint a UK Duty Representative to act for them. Further details and guidance can be found via the below websites.HMRC Excise Notice 196HMRC Excise Notice 206